are hearing aids tax deductible in uk

502 Medical and Dental Expenses. I believe that in the case of a director the cost of hearing aids would be an allowable expense for the company but would indeed be considered a P11d benefit.

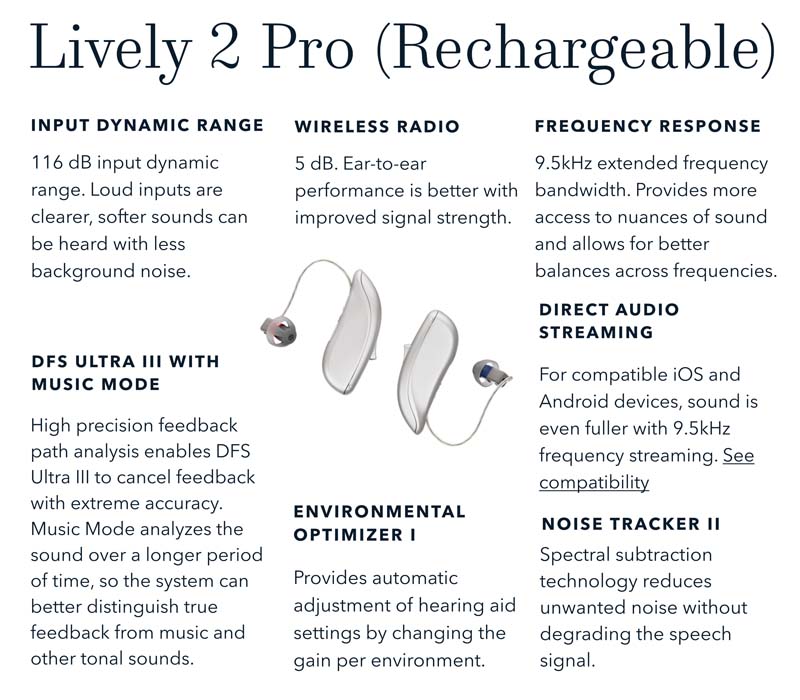

Lively Hearing Aids Reviews With Costs Retirement Living

In the case of a self-employed person the cost of hearing aids would not be allowable as the expenditure would not be wholly and exclusively.

. Read on to see which hearing aids made our list. 11 3 b Published. Starkey Hearing Foundation ATTN.

It includes hearing aid also. BiCROS hearing aids which amplify sound from both sides. Even the hearing aid batteries are tax-deductible.

For example a wheelchair or a hearing aid and private use is significant. Unit 4 Nine Mile Water Nether Wallop Stockbridge Hampshire SO20 8DR. Opticians that dispense spectacles or contact lenses to their customers make two supplies for VAT purposes.

This is exempt if you pay up to 500 for costs for an employee to return to work. The changes will take effect from 1 October 2020. For your hearing aids and hearing aid accessories to be tax-deductible you need to meet certain criteria.

This means that if you need to wear a hearing aid just for your job for instance you work in a noisy environment and need. It may be that the supply of the hearing aid is merely a portion of the overall health service and therefore subsumed. Many of your medical expenses are considered eligible deductions by the federal government.

Tax deductible hearing aids. The price of private hearing aids in the UK is amongst the highest in the world. By Les Howard.

Hearing aids that are body-worn with an earphone in the ear. Please print out the form and send the completed form to us by post at the following address. Westend61 GmbHAlamy Most people go private to gain a smaller more discreet in-ear aid which in the.

The maximum medical expense deduction for tax returns filed in 2022 is 775 for qualified unreimbursed medical expenses5 of Adjusted Gross Income will be in 2021Your adjusted gross income in an example with 40000 can increase to 80000 if that is the case or 8000 if that is the case with 6000You can deduct 5 of your AGI if you. Your employer reimbursed the expense but you were taxed on the reimbursement. Been assessed by a.

We will process the form upon receiving it and a refund of the VAT amount will be made to your account normally within 3. Best Hearing Aids From Audiologists of 2022. Similarly dispensers of hearing aids make a taxable supply of hearing aids.

Help us improve GOVUK. A deduction for the cost of a disability hearing device allows you to claim 40 45 tax relief meaning that if you pay higher income taxes you are able to take advantage of the lower tax burden. Getting tax relief essentially means that the tax.

Expenses related to hearing aids are tax. CROS hearing aids which pick up sound from the side with no hearing and feeds it to your hearing ear. Yes hearing aids are tax-deductible.

According to the Internal Revenue Service the taxpayers can deduct various kinds of medical expenses. The good news is I took your case to Hidden Hearing and it agreed to refund you in full as a gesture of goodwill. Hearing aids and other listening devices should be sent to.

Medical aids including wheelchairs hearing aids and batteries eyeglasses contact lenses crutches braces and guide dogs and their care Receipts are required to claim these costs and should be attached to your tax return if you file a paper copy by mail. A guide to the Income Tax Earnings and Pensions Act 2003. The NHS in the UK is the largest single purchaser of hearing aids in the world - not just the UK.

The 2 facts are intrinsically linked. The rules state that if your hearing aids are to be used entirely for your business you can apply for tax relief from them. If you file electronically save all your receipts together in case the CRA requests.

However it said it had already refunded 1250 to. You have paid the expenses yourself without any reimbursement. Hearing aids that are worn in the ear or behind the ear.

In some cases wearers of hearing aids may also be able to benefit from the earned. Back to homepage Back to top. Some other good nonprofits to donate to are the Lions Club Hearing Aid Recycling Program and Hearing Charities of America which is founded by Sertoma a civic service.

The spectacles or lenses themselves which are taxable at the standard rate and a supply of dispensing services which is exempt from VAT. 46 1 b Schedule. It seems clear to me that if you require hearing equipment to help you do your work its exempt from tax and BIK and doesnt need to be reported.

Health Services are generally VAT exempt as long as the practitioner is registered under the relevant piece of legislation AND the practitioner is delivering services within his specialism. As mentioned in the link NLUK posted the entire cost may be tax-deductible for corporation tax purposes but your VAT reclaim may need to be partially restricted to account for any personal use. 12th Jun 2013 1958.

Value-Added Tax Consolidation Act 2010 VATCA 2010 Ref. 09th May 2001 1306. Medical treatment to help an employee return to work.

03 August 2018 Please rate how useful this page was to you Print this page. This applies both where. Hearing Aid Recycling 6700 Washington Avenue South Eden Prairie MN 55344.

In order for hearing aids or other medical expenses to qualify as tax-deductible the total cost of all medical expenses will need to be greater than 75 percent of your adjusted gross income this includes batteries insurance and all other related expenses. On certain job-related expenses - known as a tax-deductible expense - you can claim tax relief for the amounts youve paid out. If you itemize your deductions for a taxable year on Schedule A Form 1040 Itemized Deductions you may be able to deduct expenses you paid that year for medical and dental care for yourself your spouse and your dependents.

Can I Claim Hearing Aids As A Business Expense Uk. Hearing Direct International Ltd. Bone conduction hearing aids with sound conducted through the skull.

You may deduct only the amount of your total medical expenses that exceed 7. Turbo tax a popular tax preparation software also ensure that hearing aids are tax-deductible. Since hearing loss is considered a medical condition and hearing aids are medical devices regulated by the FDA you may be able to deduct these costs.

In-ear hearing aids can be more discreet than traditional behind-the-ear models. Prices are accurate as of the publication date. You can help with a tax-deductible donation today and 100 percent of your gift will go toward our programs no salaries or.

Are Medical Expenses Tax Deductible

Soundwise Aria Hearing Aids Review Is Sound Wise Hearing Aid Kit Legit Juneau Empire

Hearing Can Be Life Changing Be A Miracle Hero Miracles Life Improvement Life Changes

Are Hearing Aids Tax Deductible In Uk Ictsd Org

Soundwise Aria Hearing Aids Review Is Sound Wise Hearing Aid Kit Legit Juneau Empire

12 Medical Expense Deductions You Can Claim On Tax Day