does tennessee have inheritance tax

What is the state of Tennessee inheritance tax rate. All inheritance are exempt in the State of.

Tennessee Retirement Tax Friendliness Smartasset

The estate tax is often referred to as the death tax.

. Use taxes are levied on products both tangible and digital that are imported and used in Tennessee. Tennessee is an inheritance tax and estate tax-free state. Inheritance Tax in Tennessee.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. For example the neighboring state of Kentucky does have an inheritance tax. However if you taxpayers will find themselves subject to.

It is one of 38 states with no estate tax. No estate tax or inheritance tax. Tennessee used to impose its own estate tax which it called an inheritance tax This tax ended on December 31 2015.

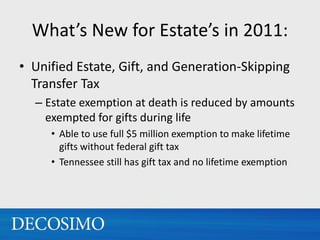

The federal exemption is portable for. What is the inheritance tax rate in Tennessee. It allows every Tennessee resident to reduce the taxable part of their.

They are imposed on the people who inherit from you and the tax rate depends on your family relationship. Tennessee does not have an estate tax. Inheritance Tax in Tennessee.

Tennessee Inheritance and Gift Tax. All inheritance are exempt in the State of Tennessee. For all deaths that occurred in 2016 and thereafter no Tennessee inheritance tax is imposed.

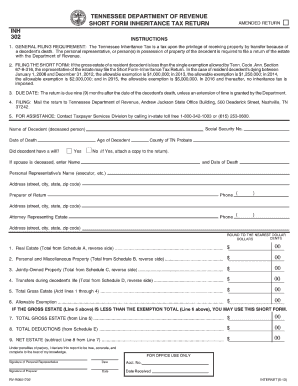

If the person passed away in 2015 and value of the decedents gross estate was. There are NO Tennessee Inheritance Tax. Tennessee is an inheritance tax-free state.

However there are additional tax returns that heirs and survivors must resolve for their deceased family members. In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. If the total Estate asset property cash etc is over 5430000 it is subject to the Federal Estate Tax Form 706.

The inheritance tax is levied on an estate. The inheritance tax applies to money and assets after distribution to a persons heirs. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply. If the total Estate asset property cash etc. There are NO Tennessee Inheritance Tax.

Tennessees sales and use tax rate is seven percent in 2017. It has no inheritance tax nor does it have a gift tax. For any estate that is valued under the exemption limit for a particular year the inheritance tax does not apply.

Also in this case you need to file Form 709. It has no inheritance tax nor does it have a gift tax. The inheritance tax is different from the estate tax.

This is for good reason as it only applies once someone passes away. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Inheritance taxes in Tennessee.

Inheritance tax is imposed on the value of the decedents estate that exceeds the exemption amount applicable to the decedents year of death. Gift and Generation-Skipping Transfer Tax Return. The net estate is the fair market value of all.

As Tennessee does not have an income tax all forms of retirement income are untaxed at the state level.

Application For Tennessee Inheritance Tax Waiver State Tn Fill And Sign Printable Template Online

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

States With No Estate Tax Or Inheritance Tax Plan Where You Die

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

Estate Planning In Tennessee Could You Benefit From A Community Property Trust Nashville Business Journal

Fillable Online Tn State Of Tennessee Inheritance Tax Return And Schedules Form Fax Email Print Pdffiller

Everything You Need To Know About Executor Fees In Tennessee

Tennessee Estate Tax Everything You Need To Know Smartasset

Where Not To Die In 2022 The Greediest Death Tax States

Tennessee Inheritance Tax Repealed Estate Planning Review Nashville

What Is The Probate Process In Tennessee Epstein Law Firm Blog

2013 Form Tn Dor Inh 302 Fill Online Printable Fillable Blank Pdffiller

2011 Estate And Tennessee Update

Tennessee Says Goodbye To Death Tax On Jan 1 Chattanooga Times Free Press

Historical Tennessee Tax Policy Information Ballotpedia